LightTrends Newsletter

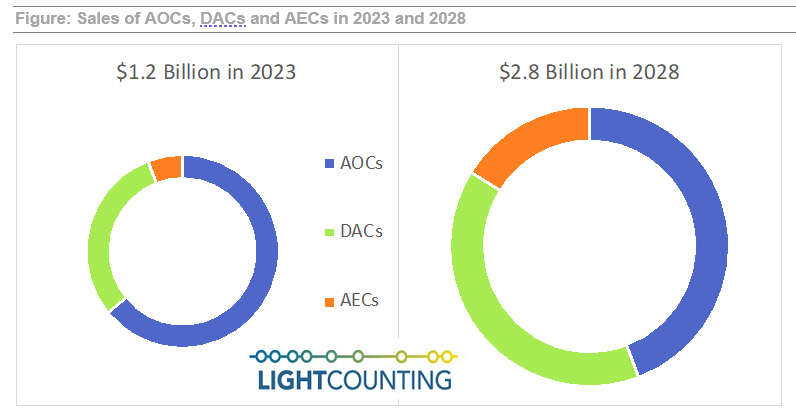

Sales of AOCs, DACs and AECs will reach $2.8 billion by 2028

LightCounting releases High-speed Cables, LPO and CPO report

Sales of high-speed cables are projected to more than double over the next five years, reaching $2.8 billion by 2028. Active Electronic Cables (AECs) will gradually gain market share at the expense of Active Optical Cables (AOCs) and passive Direct Attached Copper (DACs) cables. AECs offer longer reach and are much thinner than DACs. The cover image shows a rack of AI servers interconnected with bundles of purple AECs placed along the middle wall. There is not enough room in this design to accommodate DACs operating at 200G or higher speeds.

We also increased our forecast for DACs because new 100G SerDes enabled longer than expected reach of passive copper cables based on 100G-per-lane designs, including 400G, 800G and 1.6T DACs. We expect that 200G SerDes may also surprise us with a great performance, as they start shipping in the end of 2024. This will extend DACs into 200G per lane designs, ensuring their market position for another decade.

Since DACs consume no power, it is a default solution for connectivity in data centers striving to improve power efficiency. Minimizing power consumption is the most critical for AI Clusters. Nvidia’s strategy is to deploy DACs as much as possible and use optics only if absolutely necessary.

Our forecast for AOCs has not changed since the latest market forecast report released in October 2023. Sales of AOCs are projected to grow at 15% CAGR in 2024-2028, but sales of DACs and AECs will ramp at 25% and 45% CAGR, respectively. The outcome is lower market share of AOCs by 2028.

Nvidia is the primary consumer of 200G AOCs, but the company plans to use pluggable optical transceivers at 400G and higher speeds, instead of AOCs. Large AI Clusters will rely heavily on optical transceivers, but smaller systems will mostly use cables. While the largest Clusters will be making all the headlines, there will be plenty of smaller systems installed as well.

Our forecast methodology accounts for different architectures of AI Clusters, including Nvidia, Google and Meta. Large GPU-based clusters with two layers of InfiniBand or Ethernet switches require more connections in comparison with Google’s TPU-based systems connected using optical circuit switches.

The new report is available to subscribers at: https://www.lightcounting.com/login.