LightTrends Newsletter

A false start in the race of AI optics stocks?

LightCounting releases Q2 2023 Market Update Report

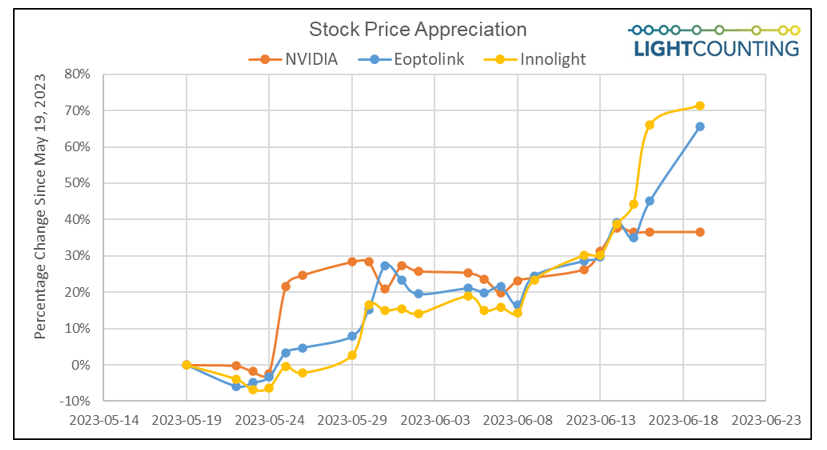

Sales of optical transceivers and related products dropped by 27% in Q1 2023 and demand has remained weak in the current quarter. Yet the stock prices of Chinese optical component suppliers are up 300-400% in 2023 so far. The figure below illustrates the performance of Innolight and Eoptolink over the last 30 days. It shows a good correlation with the 30% increase in Nvidia stock on the day of its last earnings call.

Investors anticipate that growth in demand for AI hardware will give a boost to the consumption of optical connectivity. Nvidia’s latest system design requires 800G transceivers and AOCs, but volume shipments of these systems will not start until 2024. Nvidia is experimenting with linear drive pluggable transceivers to reduce power consumption and some of its customers may choose to use these new plugins next year.

While it is not yet clear which transceivers will be used next year and which suppliers will be qualified for Nvidia systems, giddy investors are placing their bets early in the game. Google started deployments of 800G transceivers in 2021-2022. The company recently increased its forecast for purchases of 800G modules in the next 12 months, adding gasoline to the fire (the AI optics fire). Innolight and Eoptolink stocks climbed by another 30-40% last week, along with several other suppliers.

Valuations of start-up companies developing new technology for AI connectivity are also skyrocketing. The race is on. Venture capitalists investing in optical technologies of the future cannot be blamed for a false start, but the stock market is clearly overreacting.

LightCounting will be updating its market forecast for 800G transceivers in July 2023 and it will be more optimistic compared to the one published in March 2023. Yet, the current expectations of financial analysts for 5 or 8 million units of 800G transceivers to be shipped in 2024 are too aggressive.

The AI race was first triggered by ChatGPT at the end of 2022. Microsoft claimed to have the most powerful AI infrastructure, which is being used by its partner, OpenAI, as well as Nvidia and leading AI start-ups like Adept and Inflection to train large models.

All the other Cloud companies had to respond to this challenge. Google has been a pioneer in AI applications and has a huge AI infrastructure, yet it also had to accelerate AI investments. The company has halted construction of its proposed 80-acre office campus in San Jose, but it plans to build two more data centers in Ohio to help power its AI technology. Meta remains focused on striking the right balance between building out the AI capacity needed and being efficient with its CapEx spend.

Despite the belt tightening, revenue expectations of datacom networking equipment makers for Q2 2023 are solid. Cisco, Arista, Juniper and Extreme are all guiding for 2%-4% sequential quarterly revenue increases which would give them solid double-digit year-over-year growth rates of 15%, 31%, 11% and 24% respectively. HPE is seeing more growth from AI segment as well.

Broadcom reported 20% year-over-year growth in its networking revenues, driven by deployments of Ethernet switches by hyperscalers as well as TPU ASICs at Google. Nvidia’s Data Center revenue was up 18% sequentially and 14% year-over-year. The company expects 53% growth in sales for the current quarter, which is a huge increase for such a large company.

Many investors made money on Nvidia’s stock this year and they are looking for more finds across the supply chain. Chinese optical companies are the latest favorites but how long this is going to last it remains to be seen.

The Quarterly Market Update is available to LightCounting clients at: www.lightcounting.com