LightTrends Newsletter

A journey to Metaverse cut short

LightCounting reduces forecast for sales of Ethernet transceivers

Market volatility is not new or surprising for suppliers of Ethernet transceivers, but it is always stressful to see a reduced forecast. It must be part of human nature to hope for the best and ignore the warning signs for as long as possible. We rarely forecast steep market declines, but we have to be realistic with the expectations for 2023.

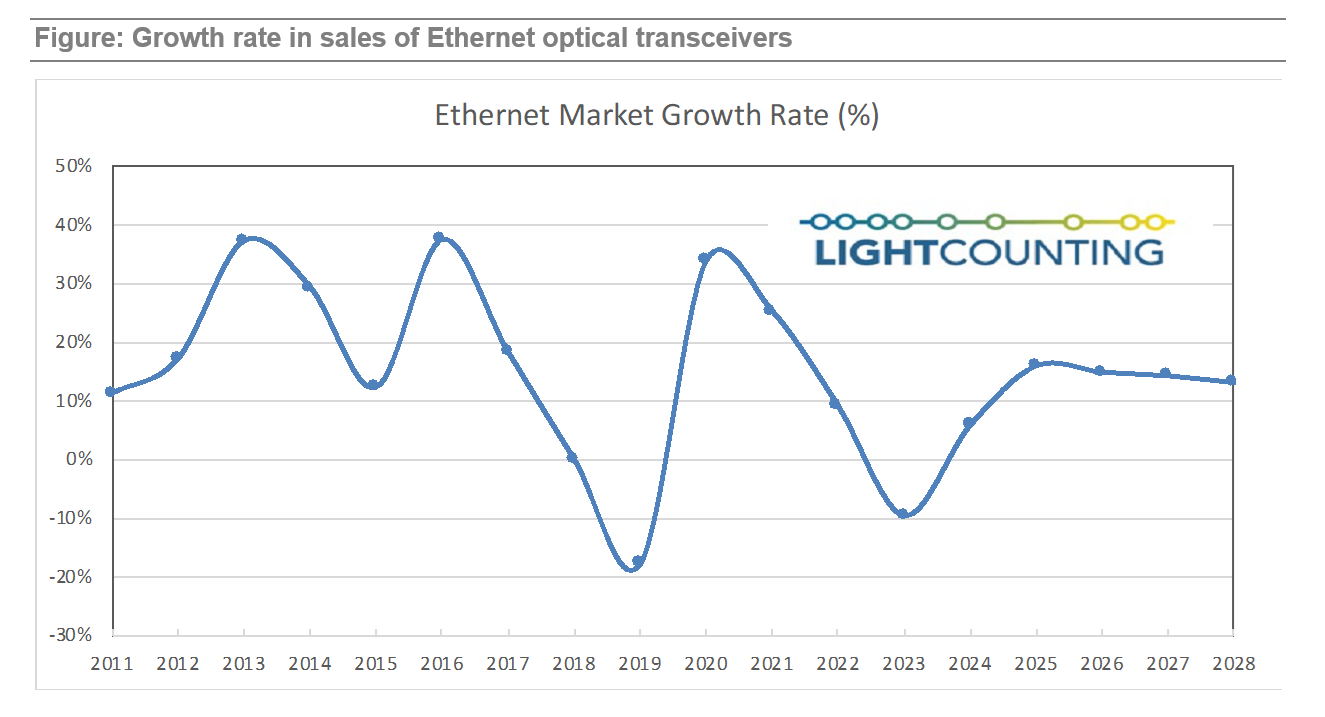

We are reducing our forecast for the sales of Ethernet transceivers in 2023 from 2% growth, projected in our October 2022 Market Forecast report, to a 10% decline. In addition, the market is not expected to reach a double-digit growth again until 2025, but the long-term CAGR remains at 13%, as illustrated in the figure below.

Market concentration – having a small number of very large customers who are prone to changing their plans, explains the volatility. Meta takes most of the blame this year. We started reducing the forecast for shipments of transceivers to Meta back in October 2022 and we are making another major cut to it now.

Meta curbed construction of datacenters and deployments of optics during COVID-19, resulting in low consumption of transceivers in 2020-2021. The huge spike in activity last year was partly a catch up on the prior two years. It was also a first step of the very ambitious plan for datacenter upgrades to support Metaverse. Meta’s original forecast for 2023 was to double the deployments of optics. The company had more than 40 datacenters under construction and upgrades last year.

Many of these plans are put on hold or scaled down now. The company publicly acknowledged its sharp shift in strategy and its plans to invest a lot more carefully in the future. However, Meta’s business growth depends on the development of new applications. With more than 2 billion users, there is not much room to scale up the existing business. Curbs on the US-based companies abroad and anti-monopoly legislation at home make innovation the top priority.

Meta confirmed its commitment to building an AI infrastructure and catching up with Amazon and Google. This is where most of its 400G transceivers are used now and 800G will be used next. We have cut our forecasts for 400/800G at Meta, but not as drastically as we cut the forecast for 200G, which are used in compute nodes.

We have not changed our forecast for shipments of 1.6T transceivers to allocate enough of these modules for supporting 40% per year bandwidth growth in datacenters operated by Google, Amazon and Microsoft.

LightCounting’s High Speed Ethernet Optics Report analyzes the impact of growing data traffic and the changing architecture of data centers on the market forecast for Ethernet optical transceivers with a focus on the high-speed modules used in data centers. It leverages extensive historical data on shipments of Ethernet modules combined with extensive market analyst research to make projections for sales of these products in 2023-2028. The report offers a comprehensive forecast for more than 50 product categories, including 1GbE, 10GbE, 25GbE, 40GbE, 50GbE, 100GbE, 200GbE, 2x200GbE, 400GbE, 800G and 1.6T transceivers, sorted by reach and form factors. It provides a summary of the technical challenges faced by high-speed transceiver suppliers, including a review of the latest products and technologies introduced by leading suppliers.