LightTrends Newsletter

Cisco and Huawei are catching up with the leaders of the optical transceiver market

LightCounting releases its May 2023 Optical Vendor Landscape Report

LightCounting’s Optical Vendor Landscape report provides a holistic analysis of the global communications industry, examining the business strategies of telecom service providers and cloud companies, their networking equipment suppliers, and down to the optical and electronic components vendors.

A detailed analysis of the revenue growth and profitability across different levels of the industry supply chain in 2010-2022 is used to identify challenges and opportunities for the future, with a deeper look at the suppliers of optical components and modules.

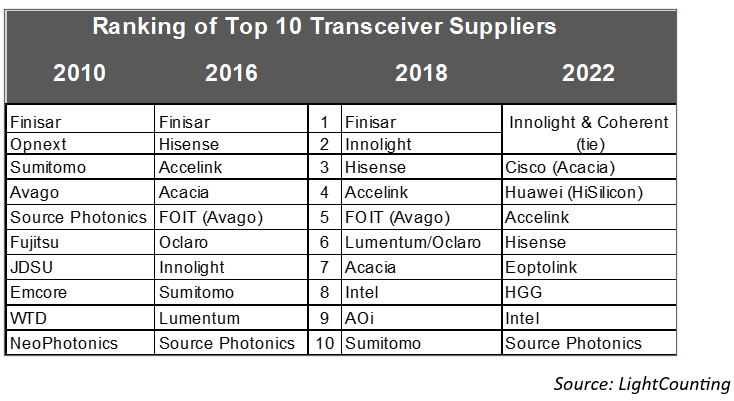

The table below illustrates the changes in the TOP10 list of optical transceiver suppliers over the last decade. A majority of the Japanese and US-based suppliers exited this market by 2020, displaced by the Chinese vendors, led by Innolight who has continually improved its rankings.

Innolight is sharing the #1 and #2 ranks with Coherent in 2022, because the difference between them is less than the accuracy of our estimates for their revenues from sales of optical transceivers and active optical cables.

The 2022 list includes Cisco which completed its acquisition of Acacia in early 2021 and Luxtera a few years before that. It also includes Huawei, since we reversed our policy of excluding modules manufactured by the equipment suppliers from our analysis. Huawei is the leading supplier of 200G CFP2 coherent DWDM modules. Cisco’s business benefited from the first volume shipments of 400ZR/ZR+ transceivers last year.

Products manufactured by Innolight, Coherent, Cisco and Huawei accounted for more than 50% of the global market for optical transceivers in 2022. Innolight and Coherent each generated close to $1.4 billion in revenue from sales of transceivers. Cisco and Huawei were not far behind. Given their huge resources, Cisco and Huawei may become new leaders in the optics market by the end of this decade.

Accelink and Hisense each reported more than $600 million in transceiver sales for 2022. Both companies were ranked higher in 2016, but they are too small to complete with Cisco and Huawei now.

Eoptolink and HGG are more recent success stories in China. Both vendors sell transceivers directly to Cloud companies, following the strategy of Innolight. Source Photonics is one of the few vendors on the Top 10 list for more than a decade, albeit their modest ranking.

Two other very large companies on our list are Broadcom (Avago) and Intel. Both companies were down in the ranking last year, compared to 2018. Intel is at #9 and Broadcom narrowly missed the top 10 list for 2022. The optical transceiver business is not a high priority for them, but both companies are developing co-packaged optics. Growth in their IC business already depends on the progress in the speed and power consumption of optical connectivity. The optics and opto-electronic integrated circuits will become even more critical for them in the future, as they replace copper in board-to-board and eventually chip-to-chip interconnects.

The report and accompanying spreadsheet are available for download by LightCounting clients.