LightTrends Newsletter

Navigating Market Volatility

LightCounting updates its forecast for Ethernet optical transceivers.

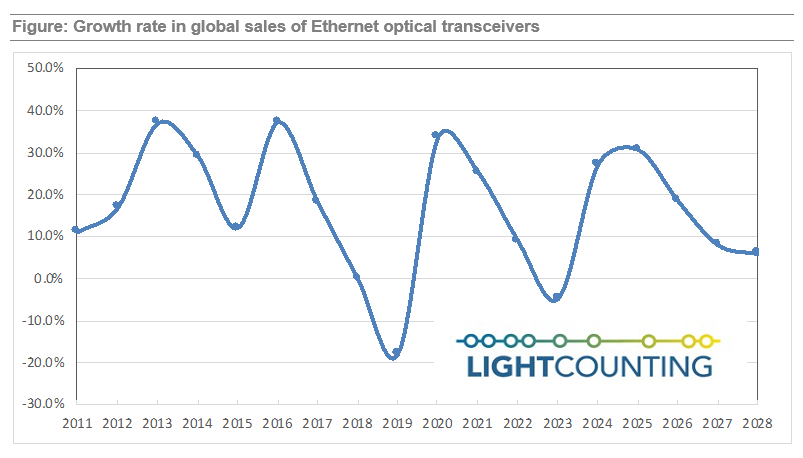

Market volatility is not new or surprising for suppliers of Ethernet transceivers, but it is always stressful to see a market decline. We expect that global sales of Ethernet optical transceivers will decline by 5% in 2023. The decline will not be as deep as the 10% drop we expected six months ago because of a very strong demand for 400G and 800G optical connectivity for AI clusters. We have also sharply increased our forecast for sales of 400G/800G transceivers for the next 2-3 years, which boosts the annual market growth rates to the 30% range in 2024-2025, as illustrated in the figure below.

Market concentration – having a small number of very large customers, which are prone to changing their plans, explains the volatility. Meta takes most of the blame for this year’s decline. Weaker demand from Amazon and Chinese Cloud companies are other factors weighing on the Ethernet transceiver market in the first 6-9 months of 2023, but all these companies are expected to purchase a bit more of high-speed optics for AI clusters in the last quarter of 2023 and a lot more in 2024.

Fears of an economic recession continue to weigh on ICP and CSP capex spending. Yet, we will not know for sure if a recession is coming until it actually starts, and it will take another half a year after that for the economists to formally declare it. By that time, we will be busy discussing the timing of a recovery.

What remains certain is that optics is critical for data centers and for the rest of the global networking infrastructure. Recent progress in generative AI makes the future even more exciting. Keep this in mind while navigating the market volatility.

The updated forecast includes more than 50 product categories, including 1GbE, 10GbE, 25GbE, 40GbE, 50GbE, 100GbE, 200GbE, 2x200GbE, 400G, 800G and 1.6T transceivers, sorted by reach and form factors. It includes historical shipment data and forecasts for units, prices, and sales of these products to each of the three main market segments: Cloud data centers, Enterprise and Telecom networks.