LightTrends Newsletter

First signs of a market recovery in Q2 2023

Publicly reported Q2 2023 financial results from companies in the optical industry made it clear that the “bullwhip effect” continued to sting optical components vendors in the second quarter of this year. High inventory levels at equipment makers and end-customers stifled sales growth at the component level. However, sales data of optical transceivers, collected by LightCounting, shows first signs of a recovery in demand for Ethernet transceivers and high speed Active Optical Cables (AOCs).

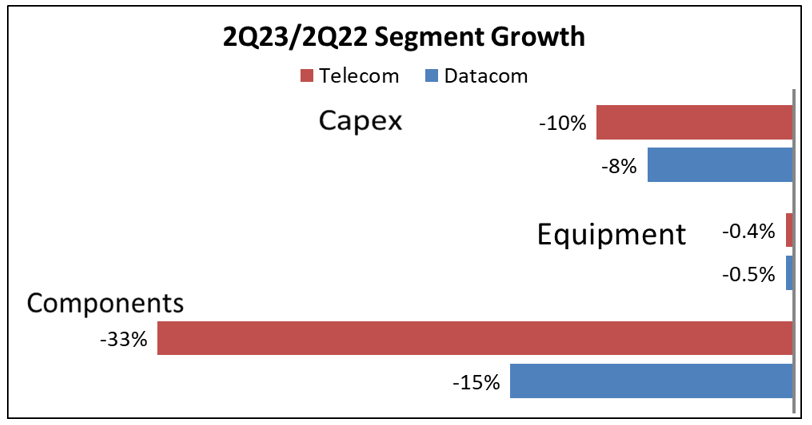

The figure below illustrates the situation across the industry supply chain. Sales of telecom optical components (DWDM, FTTx and WFH) were down 33% on a year-over-year basis and declined 14% sequentially. Sales of datacom optics (Ethernet, Fibre Channel and AOCs) were down 15% year-over-year, but sales of Ethernet transceivers were up 5% sequentially and more growth is expected in H2 2023. Sales of AOCs dropped sharply in Q1 but rebounded swiftly in Q2 2023. Most of the growth comes from demand for optical connectivity in AI Clusters. This analysis excludes direct sales of optics by Nvidia, which could easily add another 10% to growth in sales of Ethernet transceivers and 30% to sales of AOCs.

As was the case in the prior two quarters, both ICPs and CSPs again reported slowing growth in key business areas, continued layoffs, and most guided toward a moderation in spending growth in 2023. Particularly troubling is the longer-term trend of slowing growth in cloud services sales by the Top 4 mega-datacenter operators, which continued in Q2 2023, though for now it seems overshadowed by the “AI arms race”.

In contrast to the sharp declines in sales of optical components, sales of networking equipment remained steady in Q2 2023 (down 0.4-0.5%). This anomaly is explained by a heavy backlog of orders for the equipment left from 2021-2022 when many components were in short supply. The equipment vendors are still catching up on orders placed more than a year ago.

In terms of guidance for the current quarter, Amazon and Meta, Calix and Ciena all guided for double digit sales growth compared to Q3 2022. Coherent and Lumentum guided for double-digit declines, citing ongoing inventory issues among their top customers – mostly telecom equipment vendors. A recovery in demand for telecom components is unlikely in 2023.

Financial results for Q2 2023 and outlook for Q3 and beyond, as well as the latest vendor survey shipment data are presented at length in the Quarterly Market Update published by LightCounting today, which is available to subscribers.