Research Note

August 2023 Inventory dogs OC and semis vendors again in Q2 2023

Abstract

The majority of Q2 2023 financial results have been reported by western companies and are summarized in a Research Note published today by LightCounting Market Research. The data makes it clear that the “bullwhip effect” continued to sting optical components vendors and semiconductor makers for a second quarter this year, as high inventory levels at equipment makers and end-customers stifled sales growth at the component level. There were pockets of growth and exceptions to the overall trend, however.

Among the OC and semiconductor vendors, year-over-year declines in sales persisted for the second quarter in a row. Coherent and Lumentum, the two leading western optical components vendors, reported sequential declines in sales of 3%, while AOI’s sales fell by 22%. Nearly all semiconductor makers reported sales declines as well.

Datacom and broadband equipment makers seemed to fare somewhat better in Q2 than their component suppliers, with Calix, Arista, Juniper, and Extreme posting especially good results. For vendors with heavy exposure to 5G RAN, softness in North America was only partly offset by growing demand in India.

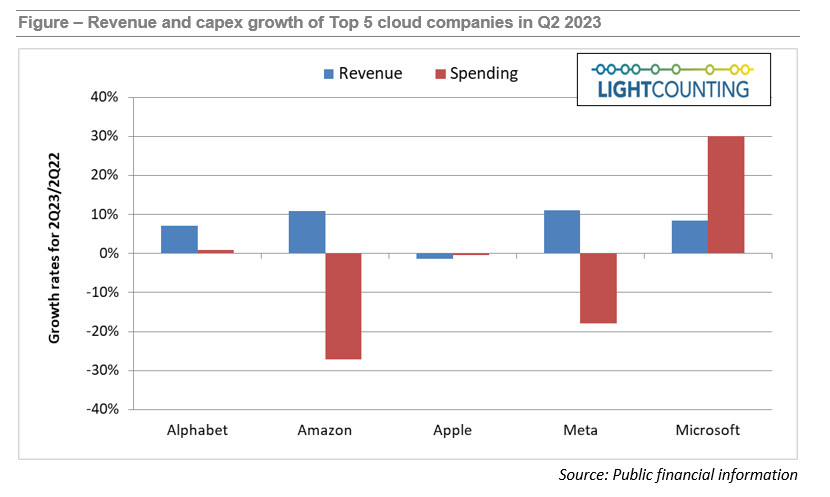

And as was the case in the prior two quarters, both ICPs and CSPs again reported slowing growth in key business areas, continued layoffs, and most guided toward a moderation in spending growth in 2023. Particularly troubling is the longer-term trend of slowing growth in cloud services sales by the Top 4 mega-datacenter operators, which continued in Q2 2023, though for now it seems overshadowed by the “AI arms race”. Microsoft outshone the others by reporting record revenues and spending a record amount as well, as shown below.

A key question now is when will inventory imbalances work themselves out? Normally this should only take a few quarters, but with slowdowns in sales and spending by end-customers layered on top, it could take longer. Some companies said they believe resolution would not come before late 2023 or early 2024.

Among the notable exceptions to the overall market malaise, Coherent reported a “surge” in AI/ML-related demand for 800G transceivers, while Lumentum said it expected shipments to Datacom customers to increase sequentially for the next several quarters. Calix, Arista, Juniper, and Extreme posted especially strong results among equipment makers, and Microchip bucked the trend in the semiconductor group.

These financial results for Q2 2023 and outlook for Q3 and beyond are discussed in greater detail in the Research Note published by LightCounting today, which is available to subscribers at: https://www.lightcounting.com/login.