Research Note

July 2023 To 400G and Beyond

Abstract

LightCounting reports from Optinet China 2023

Globalization may be in retreat, but the annual Optinet China conference strives to maintain the global discussion on new optical technologies. The latest event was opened by a welcome message to the attendees from Jose Pozo, CTO of Optica. It was full of energy and excitement, which Jose is well known for. A perfect start for a very productive event.

The organizers offered high quality simultaneous translation for most of the sessions, making it worthwhile for non-Chinese attendees. However, a limited number of flights to China and the high cost of travel were extra barriers in 2023, but this should not be an issue next year. Please mark your calendars for the first week of June 2024 in Beijing.

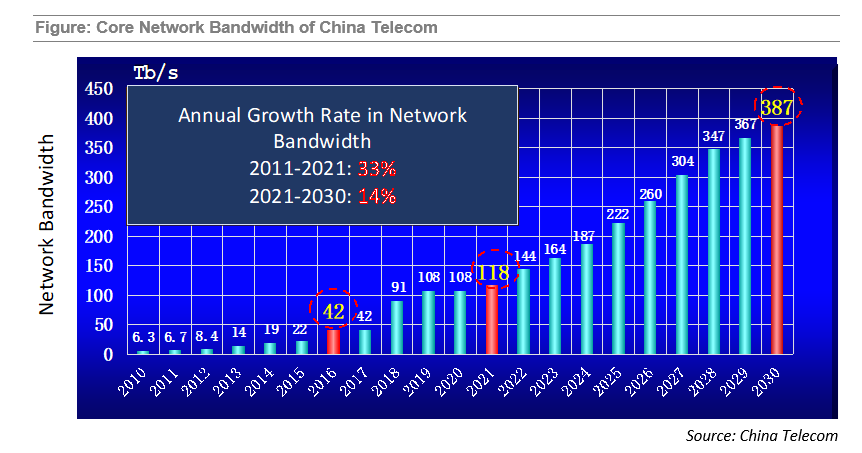

Wei Leping of China Telecom (CT) opened the first keynote session and shared the latest data and forecast for bandwidth of CT’s core network, shown in the figure below. COVID-19 interrupted growth in network bandwidth in 2020, but the annual growth rate still averaged at 33% in 2011-2021. Future plans for core network upgrades at CT are more modest: only a 14% annual increase in bandwidth is projected for 2021-2030.

According to Wei Leping, less data traffic is reaching the core network: “the IT infrastructure is becoming flat”. Horizontal connections see a lot more traffic growth than vertical, reducing the load on core routers. The flat network design helps to reduce latency and deploy more all-optical connections.

Despite the lower growth rate in network bandwidth projected for the rest of this decade, upgrades to core network infrastructure will continue. All Chinese service providers plan to start deploying 400G QPSK systems in the end of 2023 or by 2024 at the latest.

QPSK modulation enables longer reach 400G connectivity. China Mobile demonstrated a 400G connection over 5600 km, using the latest Acacia (Cisco) DSP and 130Gbaud optics. This is more than sufficient for cross-country networks in China.

Current deployments of 400G in China will rely on DSPs made by Cisco and NEL, but FiberHome, Huawei and ZTE are not far behind in developing 130Gb optics and higher speed DSPs. All these companies use internally made components for their 200G DWDM solutions. We reported on the progress in high-speed optics made by Huawei and ZTE in the past. FiberHome also demonstrated 140Gb modulators in 2023. Nationalization of WSS manufacturing was also mentioned by FiberHome at the conference.

Deployments of 400G in core networks in China will rely on board-mounted (non-pluggable) optical modules, but cloud DCI solutions will take full advantage of pluggable 400ZR+ optics.

The complete text of the research note is available to LightCounting subscribers at: https://www.lightcounting.com/login