Research Note

November 2023 Q3 2023 Early Earnings Calls Analysis

Abstract

AI and Broadband provided havens for vendors in an otherwise weak Q3. Expect more of the same until 2024.

November 14, 2023

by John Lively, Roy Rubenstein, Tom William, Stelyana Baleva and Zhou Xue

A majority of companies have now reported Q3 2023 financial results, and it’s clear that excess customer inventories again sandbagged many component vendors’ sales, while a few well-positioned component and equipment companies rode the AI or broadband waves to above average performance.

Among the OC vendors, Coherent’s Networking group sales fell 21% and Lumentum’s Cloud & Networking segment (consisting of the Datacom and Telecom product lines of the former Optical Communications segment) sales were down 36% y-o-y, due to customer inventory issues. Innolight on the other hand reported strong sales growth of nearly 15% y-o-y on the back of its 800G products, and announced a capacity expansion.

For the semiconductor vendors Q3 2023 revenues were down across the board, due to excess customer inventories, except for AMD, which was saved by its Data Center customers and AI commitments.

Datacom and broadband equipment makers were also hit with double-digit sales declines in many cases. For vendors with heavy exposure to 5G RAN, softness in NA was only partly offset by growing demand in India. A few went against the trend and reported very good results: Calix set another sales record, driven by government broadband funding; Arista and Extreme grew by double digits thanks to AI-related datacenter buildouts.

Continuing a multi-quarter trend, both ICPs and CSPs again reported slowing growth in key business areas, continued layoffs, and most continued the trend of more moderate spending growth in 2023. At the same time, the top five ICPs all doubled down on their commitments to spend whatever is needed on AI infrastructure, to position themselves for rapid growth in internal and external use of AI and machine learning models. CSPs in contrast have yet to see real gains from their 5G investments and are slow-rolling deployment of standalone 5G, to the detriment of companies like Nokia and Ericsson.

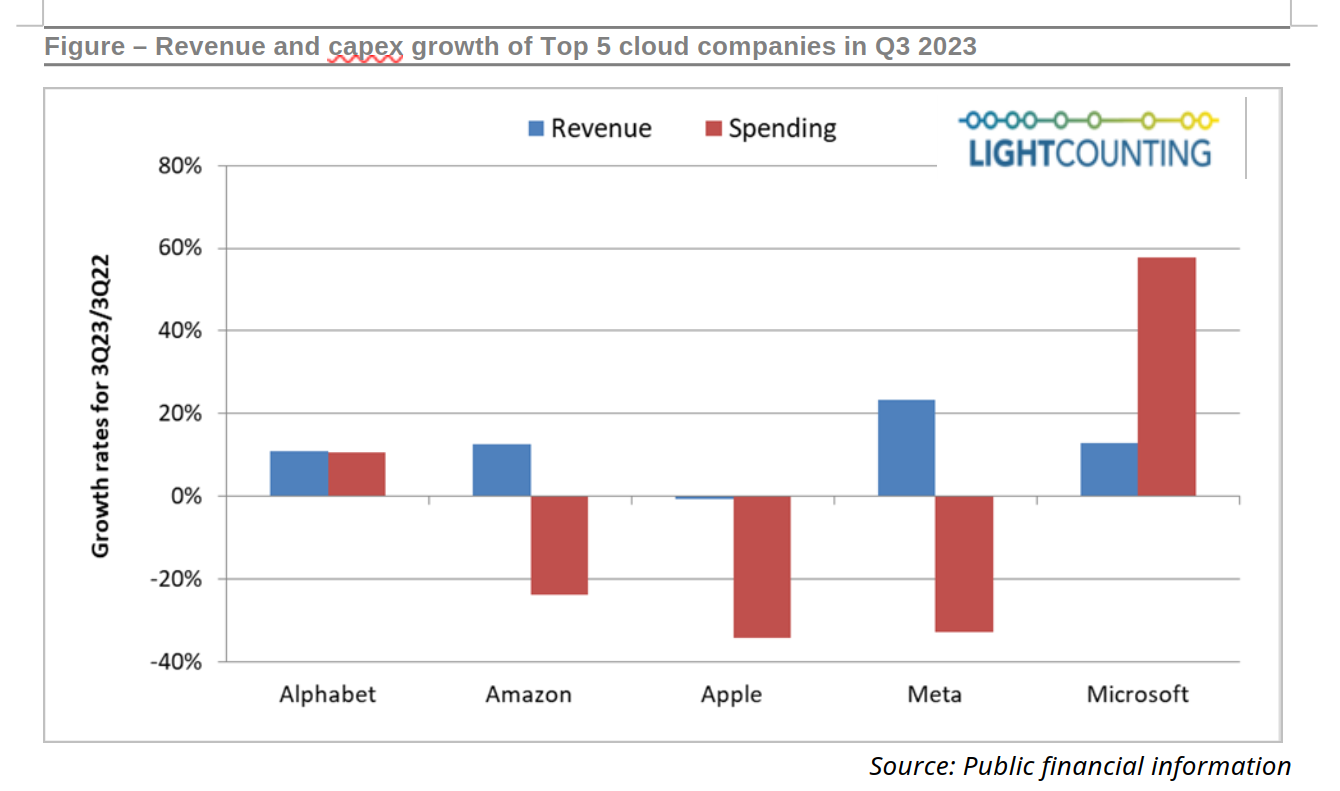

Among the Top 5 ICPs, Q3 2023 spending growth (red bars in chart below) was either “way up” or “way down”. Alphabet and Microsoft reported new record high levels and double-digit year-over-year growth, while Amazon, Apple, and Meta reported spending declines of 24%, 23%, and 33% respectively.

As was the case in Q2 2023, there were some notable exceptions to the overall market malaise. Innolight reported double-digit sales growth due to demand for 800G transceivers, and Calix, Arista, and Extreme posted especially strong results among equipment makers.

The market is at an unusual juncture with inventory overhang a strong negative influence and AI a strong positive. While it looks like Q4 will be another down quarter for most companies, we believe 2024 is looking like a year of strong growth for the industry as the negative factors wane and the influence of the positive factors gains strength.

These financial results for Q3 2023 and outlook for Q4 and beyond are discussed in greater detail in the Research Note published by LightCounting today, which is available to subscribers at: https://www.lightcounting.com/login.