LightTrends Newsletter

After a mostly down Q3, signs of recovery

LightCounting published today its Quarterly Market Update for Q3, 2023, which ended September 30. As we explain in greater detail in the report, the optical communications industry financial results for the quarter overall were not great. Every financial market indicator that we track – ICP and CSP capex, datacom and networking equipment, and semiconductor* and optical components sales – all had negative growth compared to Q3 2022. [*Semiconductor excludes Nvidia, for reasons discussed below.] The cause was a combination of belt tightening by ICPs, CSPs, and enterprises, and continued excessive inventories among many customers of the component and equipment vendors.

There were some notable exceptions to the generally downbeat results, however:

- Alphabet and Microsoft had record capital expenditures.

- Arista, Broadcom, Calix, Innolight, and Nvidia all reported record revenues.

With the exception of broadband specialist Calix, the standout equipment and component makers all had one thing in common – they all benefited from increased spending on Artificial Intelligence infrastructure by the large ICPs. Nvidia reported sales growth of more than 30% sequentially and more than 200% year-over-year, perhaps the clearest indicator of how frenzied the race to grow AI infrastructure has become.

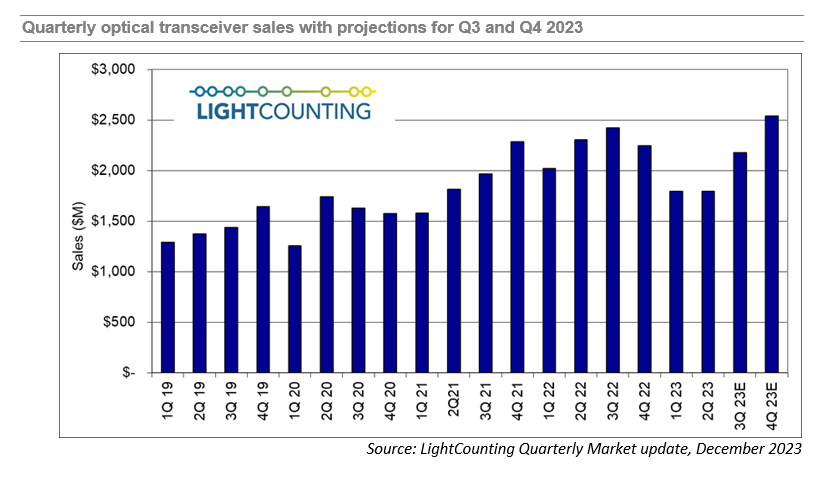

LightCounting’s Quarterly Update includes optical transceiver vendor shipment data, and although the formal survey of Q3 and Q4 shipments is not completed yet, LightCounting is projecting, based on its current analysis, that sales increased in Q3 and will increase further in Q4, to a new record high, as shown in the figure below. This data includes estimates for 400G and 800G transceivers manufactured by Nvidia internally.

This expectation of growth in Q4 carries over to 2024 as well and is consistent with the guidance given by several companies ranging from Alphabet and Amazon to Coherent and Lumentum.

The big caveat is that growth in 2024 will be tightly focused on AI-related infrastructure, and growth in demand for those products is expected to far outstrip demand in other segments like traditional telco and enterprise networks. Most of the growth in the optical components and modules market will come from sales of 800G transceivers.

LightCounting’s Quarterly Market Update consists of a PowerPoint slide deck and a data-packed spreadsheet, with both vendor survey results and publicly reported financial results across six market segments. The new report is available to subscribers at: https://www.lightcounting.com/login.