LightTrends Newsletter

Chinese transceiver vendors dominated the market in 2023

LightCounting releases Vendors and Markets for Optics in China report

Chinese manufacturers of optical components and modules reached a milestone in 2021: revenues of the top 10 Chinese suppliers surpassed sales reported by their western competitors. This gap widened in 2022-2023 in favor of the Chinese suppliers. Their initial success was facilitated by strong demand for optics inside of China, but it was the sales of optics to the US-based Cloud companies that propelled Innolight and few other vendors to new sales records.

Custom duties imposed by the US government on products made in China, including optical transceivers, forced many Chinese suppliers to establish manufacturing sites in Thailand, Vietnam or other countries in East Asia. This required additional investments, but it will pay off over many years to come. Lower labor cost in East Asia is another benefit, which may become even more important in the future. Many young people in China are no longer willing to take the factory jobs, which propelled their parents out of poverty in the past.

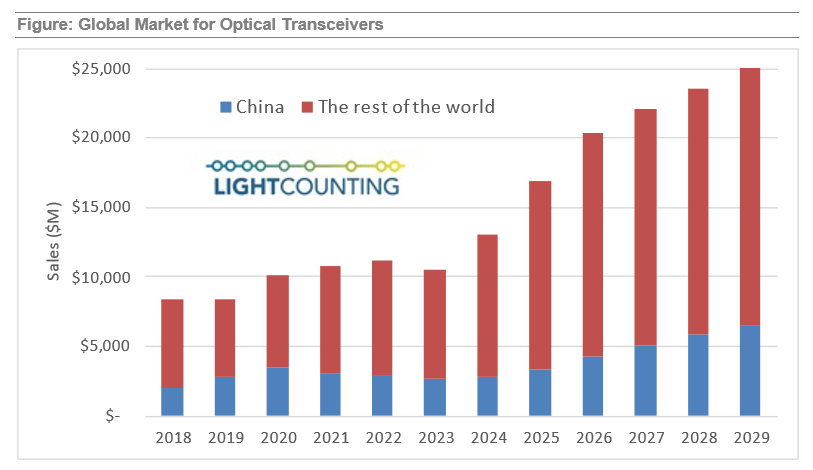

Steady investments in optical networking infrastructure in China created a $2-$3 billion domestic market for Chinese suppliers of optical transceivers, as illustrated in the figure below. Our latest forecast suggests that deployments of optical transceivers in China will account for 20-25% of the global deployments in 2024-2029, compared to 25-35% in 2018-2023. Very aggressive plans of US-based Cloud companies for deployments of 800G optics in AI Clusters is the main factor reducing China’s share in the next 2-3 years. We expect that Chinese cloud companies and telecom service providers will be catching up with their western rivals in their spending on optics by 2027-2029.

Another government priority which is impacting the decisions of Chinese cloud companies and telecom service providers is the desire to allocate more business to local manufacturers – not only of transceivers, but also of the laser and detector chips used in them. Despite significant progress made by Chinese chip suppliers, they are 2-3 years behind their western competitors in the development of high speed (100G per lane) components. Lack of domestic supply for 4x100G and 8x100G transceivers may limit their deployment in China for the next 3 years, but we expect volume deployments of these products in China to start in 2027.

Despite all the challenges, China will remain a significant market for suppliers of optical transceivers and a critical part of the industry’s ecosystem.

The report is available to subscribers at: https://www.lightcounting.com/login.