LightTrends Newsletter

Two sides of the market – two different stories

LightCounting releases its Q1 2024 Quarterly Market Update

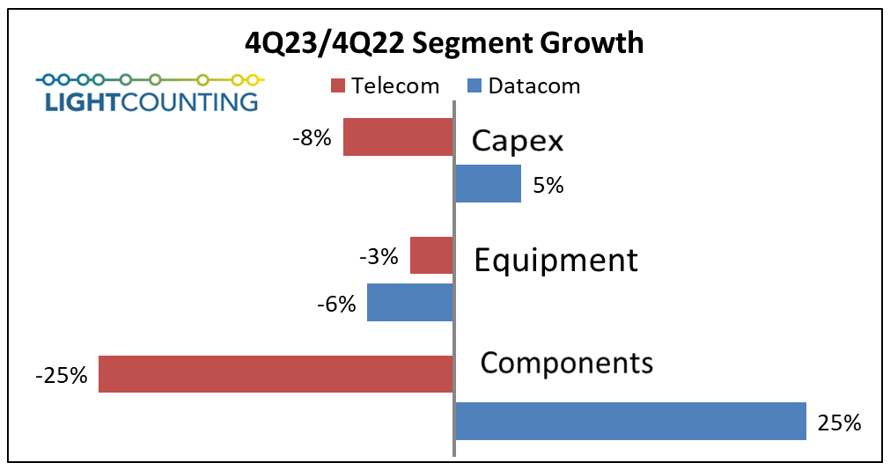

This is not the first time the industry’s scorecard, shown in the figure below, points to a divergence between the telecom and datacom parts of the optical communications market. Cloud companies continue to increase spending, while telecom service providers are struggling to keep their networks running. A decline in sales of telecom components, which include DWDM, FTTx and Wireless Fronthaul transceivers, would have been even sharper without a pickup in sales of 400ZR/ZR+ modules to Microsoft and Amazon in Q4 2023.

Sales of 800G Ethernet transceivers surpassed sales of 400G modules for the first time in Q4 2023. Shipments of 800G 2xFR4 and FR8 modules to Google were off the chart: up 2x sequentially and 30x compared to Q4 2022 (in terms of units shipped). Not surprisingly, suppliers to Google guided for a pause in H1 2024, but the demand is not going away. Growth in sales of 800G (8x100G) modules will continue in 2024-2025, despite first shipments of 4x200G and 8x200G transceivers expected in H2 2024.

Nvidia was the second largest consumer of 800G optics (mostly SR8) last year, but it will become the new #1 in 2024. The company recently decreased its original forecast to suppliers for 2024 by 20-25%, but it still remains well above the 4-5 million units of 800G transceivers allocated to Nvidia in our forecast model for this year. The two forecasts are on converging trajectories, which is how we like it. Our projected doubling of this demand in 2025 remains uncertain since it depends on whether NVLink connections over fiber will become available to Nvidia’s customers. This will be the most efficient way to scale GPU arrays and it will require 2-3x more bandwidth compared to the InfiniBand connections used now. We may learn more about it at GTC 2024.

There are signs of recovering demand from many other Cloud companies across a wide range of Ethernet transceivers, but growth in sales is limited by sharp declines in average selling prices. In the most extreme example, prices of 400G SR8 transceivers fell by 50% by the end of last year, compared to the end of 2022. The demand shifted from US-based to Chinese Cloud companies, which always pay less. Several Chinese suppliers now offer less expensive 50G VCSEL arrays and even DSPs for 400G SR8 and other types of transceivers.

Demand for telecom equipment and DWDM optics is also rebounding in China with initial deployments of 400G solutions over long haul and regional networks, including the East-West datacenter network project. China Mobile started it in Q4 2023, and China Telecom and Unicom are starting it now.

LightCounting’s Quarterly Market Update consists of a PowerPoint slide deck and a data-packed spreadsheet, with both vendor survey results and publicly reported financial results across six market segments. The new report is available to subscribers at: https://www.lightcounting.com/login.