LightTrends Newsletter

Lumentum is back in. Intel is out.

Making sense of two notable transceiver deals

November 2, 2023

by Vlad Kozlov

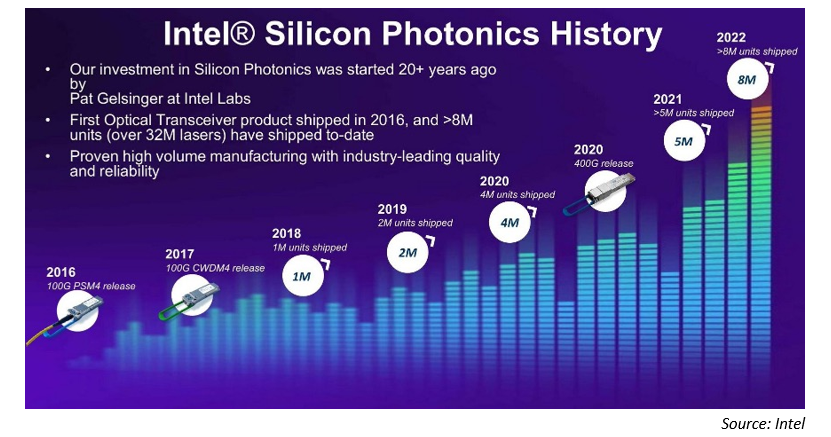

Intel deserves a lot of credit for bringing silicon photonics to the mainstream optical transceiver market. The company developed this technology internally for more than two decades prior to launching 100G PSM4 and CWDM4 transceivers in 2016-2017. Intel gained significant market share in 2018 and forced its competitors to take this technology seriously.

Today all the leading suppliers of optical transceivers are selling or developing products with at least some components based on silicon photonics. Numerous start-ups are challenging the leaders. Many foundries and design firms offer PDK for photonic integrated circuits on a silicon photonics platform. Even TSMC recently made a rare announcement that it plans to develop silicon photonics chips based on 7nm CMOS.

Silicon photonics is supported by a vibrant ecosystem now. Creating it must have been the real objective of Intel. Extending the benefits of CMOS technology to optical interconnects would ensure that the optical industry has a path for reducing the cost and improving performance of optical transceivers. An optical version of Moore’s law may not be as powerful as the original one, but the benefits of CMOS manufacturing are compelling.

Why was Intel concerned about the optics? High speed connectivity between servers and switches is a potential bottleneck for scaling the bandwidth of Network Interface Cards (NICs), which can limit demand for CPUs and other complex ICs, which Intel manufacturers.

This problem is not new. Intel recognized it in the late 1990’s and acquired a small optical transceiver company in early 2001. This had nothing to do with silicon photonics, but it gave Intel an entry into the optical industry and the standard bodies governing it. The company contributed to 10G SFP+ standards, designed with cost reduction in mind. Selling prices of 10G optical transceivers were above $1,000 in 2001 but dropped to below $100 by 2010. They sell for $10 now.

Google was the first Cloud company to deploy large quantities of 10G SFP+ modules back in 2010. Lumentum was Google’s first supplier of 10G SR optical transceivers back then. It took Finisar several years to gain share at Google. Lumentum’s acquisition of Cloud Light puts the company back in competition with Finisar (now part of Coherent) in SR transceiver market. This time it is 800G SR8, based on 100G VCSELs. It is the right time to get back into this market, as illustrated in our recently published market forecast.

Cloud Light also benefited from sales of SR transceivers to Google. This started with 100G SR4 a few years ago and continued with 400G SR8 more recently. Headquartered in Hong Kong, Cloud Light was founded in 2018 as a spin-off from TDK Corporation. It has offices in Hong Kong and Taiwan, and state-of-the-art manufacturing facilities in Southern China and in South East Asia, including a fully automated manufacturing line for SR transceivers.

Adding Cloud Light SR transceiver manufacturing to Lumentum’s 100G VCSELs makes a lot of sense for getting ahead in the race to supply 800G SR8 transceivers to Nvidia. Coherent and Innolight have a long history of supplying Mellanox and Nvidia with AOCs and these companies are gearing up supply 800G SR8 transceivers as well. Coherent developed 100G VCSELs internally. Innolight and many other suppliers are relying on Broadcom’s 100G VCSELs, which were developed at least a year ahead of Coherent’s and Lumentum’s lasers.

The acquisition of Cloud Light is a reversal of Lumentum’s strategy to focus on high-end DWDM coherent transceivers and supply laser chips for datacom applications. The company sold its datacom transceiver business to CIG a few years ago. The DWDM transceiver market is growing, but not as fast as Lumentum has expected. Getting back into the datacom transceiver market carries a lot of risk, but it will boost Lumentum’s revenues if everything goes well.

One of the new challenges for Lumentum will be sustaining sales of laser chips (VCSELs and EMLs) to datacom transceiver suppliers, which will become Lumentum’s competitors when the Cloud Light deal closes.

While it is divesting transceiver manufacturing and customer support to Jabil, Intel is keeping the SiP chip design and chip manufacturing capabilities in house. The company plans to continue development of co-packaged optics, which will eventually be needed for server-to-switch and even chip-to-chip interconnects. This is the real long-term strategy for Intel’s adventure into silicon photonics.

Full text of the research note is available to subscribers at: https://www.lightcounting.com/login