LightTrends Newsletter

Newsletter in Chinese Newsletter in Japanese

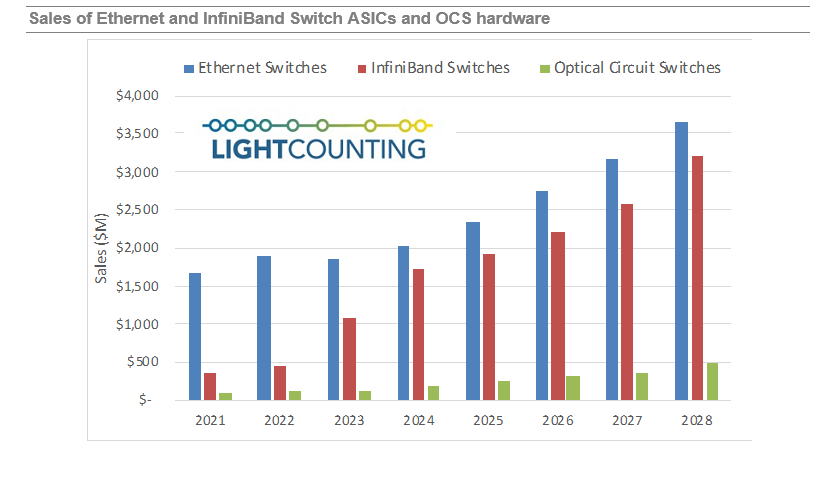

Demand for AI hardware boosts sales of InfiniBand switches in 2023-2024, but more growth is expected for Ethernet and Optical switches in the next 5 years

LightCounting updates the forecast for Ethernet, InfiniBand and Optical switches for Cloud Datacenters

New focus on AI applications boosts sales of Nvidia’s systems in 2023. We estimate that sales of their InfiniBand switch ASICs will almost triple in 2023, compared to 2022. This strong growth will extend into 2024 prior to moderating in 2025-2028, averaging at 24% CAGR in 2023-2028.

Sales of Ethernet switch ASICs are expected to be flat in 2023 because of lower investments in compute nodes within Cloud Datacenters, but this market will return to growth in 2024 and accelerate after that. The majority of Cloud companies plan to use open-source Ethernet switches in their production AI infrastructure instead of proprietary InfiniBand solutions. We estimate that the sales of Ethernet switches will grow at 14% CAGR in 2023-2028.

Google is also accelerating its investments into AI infrastructure, which relies heavily on optical circuit switches (OCSes). Other companies are considering deploying them as well and taking advantage of savings in cost and power consumption in OCS-based datacenter networks. We increased our forecast for sales of OCS hardware which is now projected to grow at 32% CAGR in 2023-2028, also shown in the figure below.

This report also includes a forecast for Ethernet switch ASICs with co-packaged optics (CPO). The impact of CPO adoption is not as significant as we estimated in the first edition of this report published in April 2022. This is partly due to revised assumptions on pricing of switching ASICs. Also, adoption of CPO is likely to take longer since linear drive pluggable optics (LPO) offer similar savings in power consumption for 100G-per-lane transceivers. We now expect that CPO will be mostly used on 200G-per-lane switches, but it still adds $250 million to the Ethernet switch ASIC market size in 2028.

The report offers brief profiles of the leading suppliers of merchant switch ASIC and system integrators offering products to Cloud companies. Several suppliers cancelled 25.6T ASICs in the last 12-18 months. Intel announced that it was ending development of its Tofino line of switch ASICs, but it continues to sell the 12.8T Tofino 2 generation. Marvell (then Innovium) and startup Xsight Labs sampled 25.6T switch ASICs, but problems with the 100Gbps SerDes blocks led both companies to cancel those products. Marvell has since sampled a 51.2T chip using internally designed SerDes.

Among the system integrators, Micas Networks Inc., incorporated in 2023, assumed the assets of Ragile Networks Inc., which itself was formed in 2020. Ragile was a US subsidiary and brand of Ruijie Networks, a much larger and older Chinese bare-metal networking hardware maker. At the October 2023 OCP Summit, Micas Networks displayed a wide range of switch systems, including the new M2-W6940-128QC, based on Broadcom’s 51.2T Tomahawk5 ASIC. It also showed a 4U switch system with fully co-packaged optics. This 51.2T CPO system uses Broadcom’s Bailly CPO device and provides 128 x 400G-FR4 ports using LC connectors.

The report is available for download by LightCounting clients.