LightTrends Newsletter

Newsletter in Chinese Newsletter in Japanese

Looking Beyond 2023

LightCounting updates Market Forecast for 2024-2028

Demand for optical connectivity started to decline in the second half of 2022 and this created excess inventories across the supply chain. The market outlook for 2023 was really gloomy six months ago. Leading transceiver and component vendors reported sharp declines in revenues in early 2023. Prospects for the second half of this year and even 2024 were dire.

Nvidia boosted industry morale by reporting huge growth in sales of AI hardware, including optical interconnects, in its last two quarterly reports. Google increased its plans for investments in AI Clusters, and many other Cloud companies followed. All of a sudden, expectations for 2024 are sky high. Components for 4x100G and 8x100G transceivers are already in short supply.

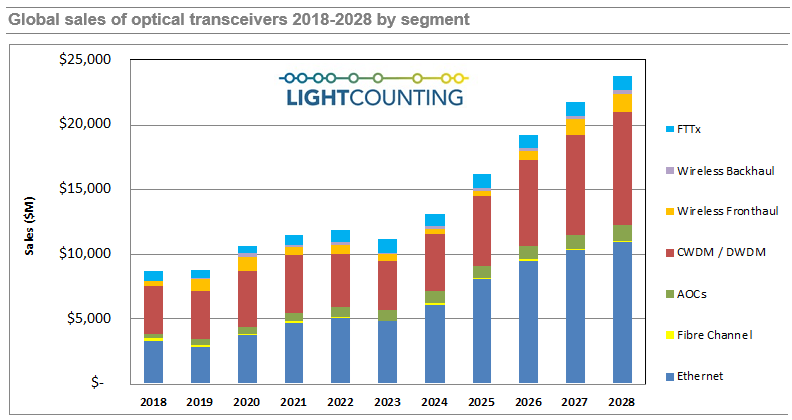

It is too late to prevent a decline in the market for 2023, as shown in the figure below, but we now project close to a 30% increase in sales of Ethernet transceivers in 2024. All other market segments are projected to recover or continue growth next year as well, albeit at more modest rates. The global transceiver market is projected to expand at a 16% CAGR over the next 5 years, after a 6% decline in 2023.

Amazon, Google, Microsoft and other cloud companies are expected to lead in the development of new AI applications. This will require significant upgrades to their AI Clusters, which use a lot of optical connectivity: mostly 400G and 800G Ethernet transceivers and AOCs for the next two years. Upgrades to DC Cluster connections are also accelerating, which means growth in shipments of 400ZR/ZR+ in 2024-2025 and 800ZR/ZR+ after that.

The Cloud companies benefited from the COVID-19 pandemic, but they were forced to reassess their plans at the end of 2022, as growth slowed. Their capex almost doubled between 2019 and 2022, but current investments are more conservative. The Top 15 ICP’s capex is projected to be up only 1% in 2023, essentially flat, after several years of double-digit growth. However, investments in AI infrastructure remain a priority in 2023, taking a larger share of total capex. Unless there is an economic recession, we expect that Cloud companies will return to steady (double digit?) growth in investments for 2024 and beyond.

Telecom service providers plan to reduce their capex by 4% in 2023. A surge in capex spending by CSPs in 2024-2028 is unlikely since they are struggling to find new sources of revenue. Deployments of 5G have not changed this situation, at least not yet.

Connecting businesses and consumers to the Cloud is a new priority for telecom operators. Large enterprises can establish private connectivity to the Cloud, but consumers, small and medium businesses have to rely on telecom networks. This presents a potential opportunity for telecom service providers: offering low-latency broadband connections to the Cloud for a broader range of customers and generating additional revenue. Supporting these services will require continuing investments in access and metro networks.

This report provides a detailed market demand forecast through 2028 for optical transceivers and a few related products used in Ethernet, Fibre Channel, CWDM/DWDM, wireless infrastructure, FTTx, Cloud datacenter and AI Cluster applications.

The report is available for download by LightCounting clients.